Reliable investment services

- Professional fund management with quarterly reports.

- Diversified and conservative strategies (secured debt, secured loans, high-quality credit assets).

- Periodic (monthly or quarterly) distributions for cash flow.

- Liquidez a partir de 30 días y sin largos períodos de bloqueo en la estructura estándar.

- Personalized support: tax and financial advice for investors.

Asset Found Information

Structure, Purpose and Strategy

- Legal structure: Private fund (LLC) with operational headquarters in Mesa, Arizona. Structure designed for accredited and non-accredited investors depending on the product.

- Purpose: Protect capital and generate stable income flows through conservative investments and rigorous due diligence.

- Investment strategy: Secured loans, selective mortgages, high-quality credit assets.

- Risk management: Due diligence, stress testing models, concentration limits and insurance.

- Performance target: 7–10% annual (approximate).

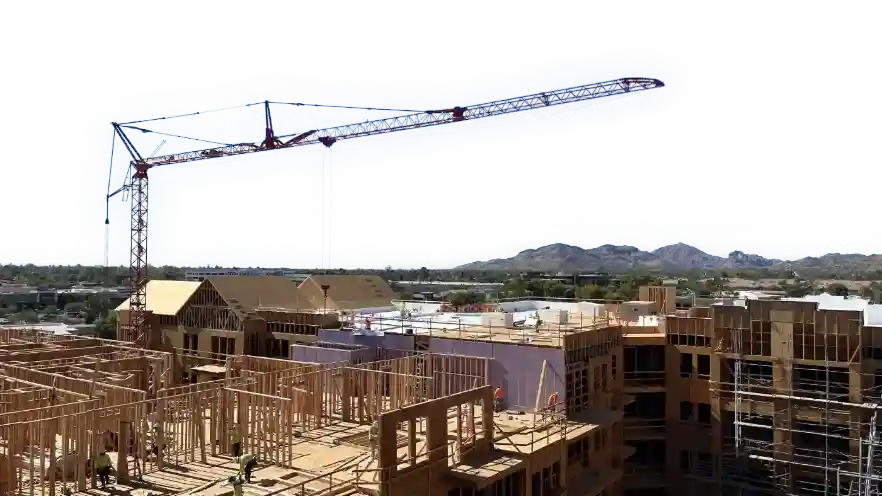

Our Projects

Coming Soon

Management Team

Experience and Transparency

Álvaro Bazan

CEO & Co-founder

Strength, vision and strategy. Álvaro Bazán, Certified Public Accountant from the University of Arizona, has built over 20 years of success in finance and private investments, moving assets over $850 million and leading high-performance teams.

His hallmark is determination and precision: he optimizes every process, anticipates risks, and transforms challenges into opportunities. Under his leadership, Asset Performance Fund moves forward with power, confidence and a clear goal: to grow without limits.

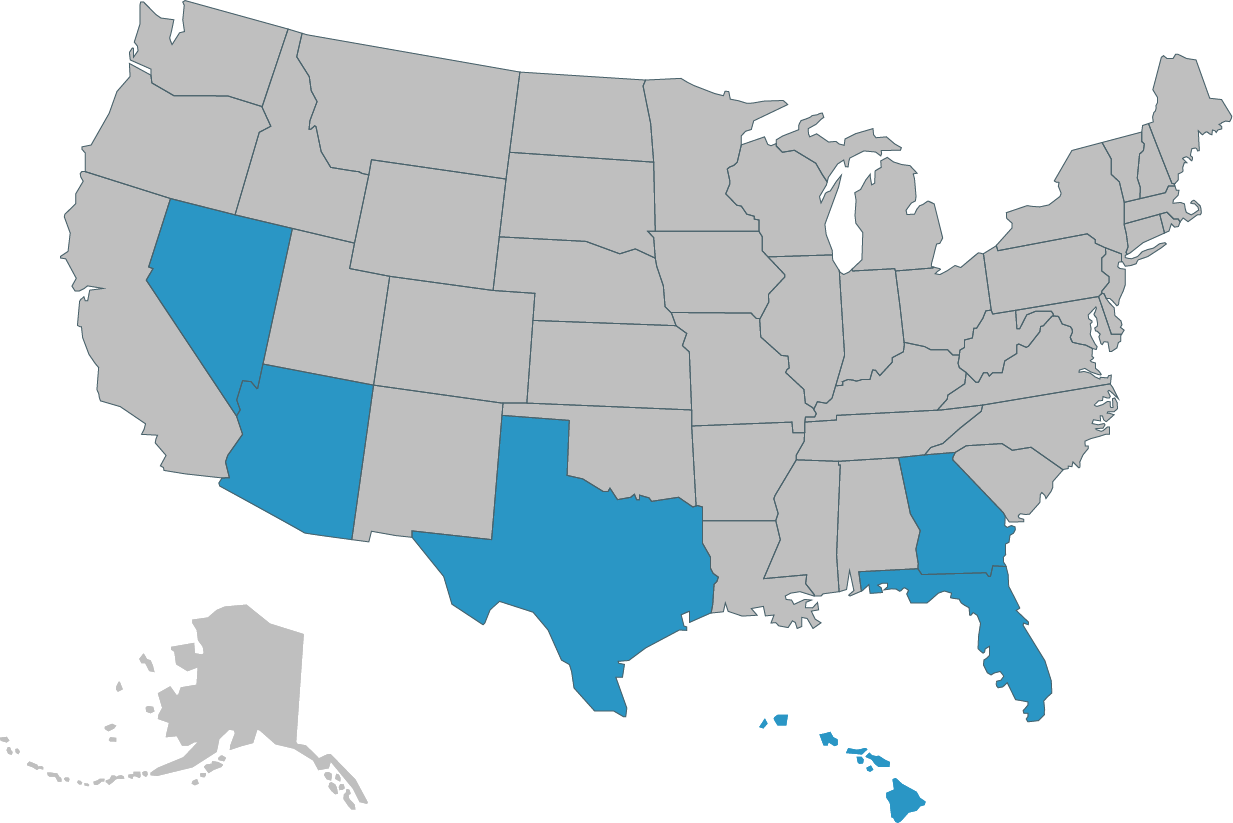

Where We Operate

Our headquarters is located in Mesa, Arizona. With operations in key U.S. markets: Phoenix, Las Vegas, Dallas, Houston, Atlanta and Miami.

Our clients include professionals, family businesses and family offices seeking low-volatility products.

Track Record and Performance

Frequently Asked Questions

The fund aims to generate stable returns in an average annual benchmark range (example: 7-10%), depending on market conditions and available investment opportunities.

The minimum investment amount usually varies depending on the specific offering and investor profile, but generally starts at an accessible level for those looking to diversify their portfolio with private funds.

The fund is designed to offer flexible liquidity in short terms (example: starting at 30 days), allowing investors to access their capital without long lock-up periods, subject to the conditions stipulated in the official documentation.

The fund employs conservative strategies, with assets backed by real guarantees and a rigorous risk analysis process. Although all investments carry some level of risk, the objective is to protect capital and maintain low volatility.